The Insurance Regulatory and Development Authority (IRDAI) has come out with an exposure draft on Guidelines on Standard Travel Insurance Policy. The reason behind this is to make a standard travel insurance product available with common coverage and common policy wordings across the industry.

Insurers are allowed to offer the optional covers along with the standard product. The premium for the same may be different across insurance providers since it will depend on the covers proposed to be offered. As per the IRDAI directive, every General as well as Stand-alone Health Insurer shall endeavor to offer this product from 1st April 2021 onwards.

On December 28, 2020, IRDAI said on the issues draft guidelines that the standard product shall have the basic mandatory covers as specified in draft guidelines which shall be the same across the industry. The product maybe availed both as an individual and/or as a group product.

Why Was There a Need to Standardize Travel Insurance?

Despite the fact that there are several travel insurance products available in India, the penetration of travel insurance is yet to kick off. In addition to that, each product has exclusive features and the insuring public may find it very hard to pick an appropriate travel policy. Hence, in order to intensify the penetration of travel insurance, which shall offer a safety net to every individual who is travelling, it is considered vital to have a standard travel product, as per the draft guidelines issued by the Regulator.

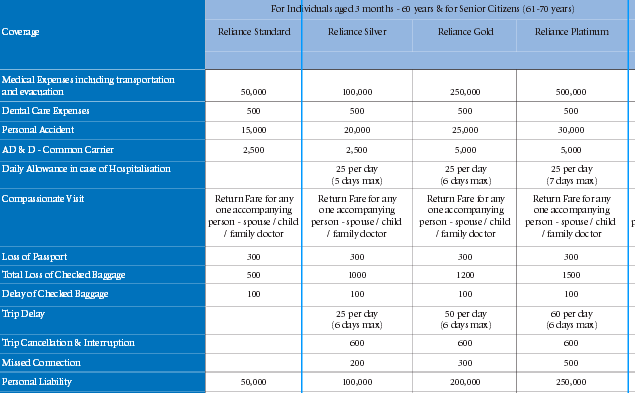

Under Domestic Travel, there will be 5 variants of this standard travel policy and under Overseas Travel, there will be 4 variants.

Domestic Travel Variants:

- Travel by any mode of public transport (Outside City)

- Travel by any mode of public transport (Within City)

- Air-travel

- Train Journey

- Domestic Tours involving Road, Water, Train and Air travel

Overseas Travel Variants:

- Long-term Trip (Students)

- Multi-trip during the policy period (Business)

- Short-term trip as in Tours/Leisure (Covers travel through Road, Water, Train and Air)

- Coverage only for Travel (Onward and Return)

What Will Be the Policy Period?

- Under domestic travel insurance, the policy will offer coverage only during the period of the journey.

- However, under the under overseas travel insurance, both stay and travel is covered, under most plan variants.

Category of the Cover

- The coverage in the Standard travel insurance policy will be based on indemnity and benefits.

- The Standard travel insurance will be offered on an individual, family floater and on a group basis.

The Indian travel market is one of the biggest in the world, according to IRDAI. As per reports, around 36% of Indian households undertake trips for one purpose or other. Such trips are both within and outside the country. While it is indispensable that every travel undertaken shall be a safe journey, there is a necessity to ensure that every trip a secured journey by offering a suitable safety net.

IRDAI has invited suggestions on the exposure draft from stakeholders till January 6, 2021.

In the meantime, to make family floater health insurance covers simples for policyholders; the Insurance Regulator has also asked insurers to clearly spell out the benefits and sum insured for each family member covered to the make the difference clear between the accessibility of coverage under family floater basis and on an individual basis vis-a-vis the premium to be paid.